You’re Measuring Value Wrong — And It’s Costing You

As a kid, I thought my mother was just justifying expensive purchases when she said: “Cost is what you pay, value is what you get.” Turns out, she was laying out the single biggest reason businesses make bad decisions.

A cheap pair of shoes that fell apart in six months? Bad value, even if they were on sale. A well-made pair that lasted years? Good value, even if they cost twice as much (and even if my younger self thought they looked a bit lame).

I see it everywhere. Businesses obsess over cost — budget, burn rate, margins. But value? That’s trickier. It’s assumed rather than measured, debated rather than understood. And the real challenge? Value isn’t a number. It’s contextual.

Take the diamond-water paradox. If I offered you diamonds or a bottle of water, you’d take the diamonds without hesitation. But if you were stranded in the desert, dying of thirst? The water would be worth more than all the diamonds in the world. Value isn’t fixed — it depends on circumstances, need, and perspective.

This is where businesses often get it wrong. They optimise for cost or efficiency without understanding what their customers actually value. They focus on outputs instead of outcomes, thinking that more automatically means better. But bad decisions follow when customer and business value don’t align.

“Price is what you pay. Value is what you get.” — Warren Buffett

So let’s talk about it. What is value, really? How do we balance what customers care about with what keeps a business alive? And how do we avoid the trap of optimising for one at the expense of the other?

The Value Misalignment Problem

Businesses love to talk about value. They throw the word around in strategy decks, mission statements, and customer promises. “We deliver value!”, “Creating customer value is our priority!” But ask ten people in the same company what that actually means, and you’ll get ten different answers.

That’s because value isn’t one thing — it depends on who’s looking at it. Customers see value in terms of outcomes: Does this solve my problem? Does it make my life easier, faster, better? On the other hand, businesses tend to see value through internal metrics: Revenue, efficiency, margins, and market share. The gap between these two perspectives is where things go wrong.

Take a classic example: customer support. A business focused purely on cost efficiency might decide to replace human agents with AI chatbots. On paper, this looks great — support costs go down, response times speed up, and executives pat themselves on the back for optimising operations. But from a customer’s perspective? The chatbot can’t solve their issue, so they go in circles trying to reach a real person, and frustration builds. The company saved money, but at what cost? If enough customers leave due to a terrible experience, that efficiency win becomes a long-term loss.

Or look at product development. Many teams measure success by the number of features shipped. More features = more value, right? Not necessarily. If those features don’t solve real customer problems, they’re just expensive distractions — bloat that cranks up the friction of the product in use. But because businesses often equate “delivering value” with “delivering something,” teams get rewarded for shipping more, not for improving things.

This disconnect happens all the time. Companies optimise for what they value, not necessarily what customers value. When those two things aren’t aligned, businesses make decisions that look smart internally but hurt them externally.

So how do we fix this? First, by recognising that value isn’t just what a company wants to deliver — it’s what customers experience and care about. Second, by understanding that business value and customer value don’t have to be at odds — when done right, they reinforce each other.

The best companies don’t just talk about value. They define it, measure it, and align their decisions to it. And let’s go there next.

When Value Gets Lost: Common Pitfalls

It’s easy to talk about value. It’s much harder to deliver it consistently. Even companies with the best intentions fall into traps that make them think they’re providing value when, in reality, they’re doing the opposite.

Sometimes, the mistake is betting the farm on certainty — believing so strongly in an idea that you ignore all evidence to the contrary. Other times, it’s an invisible drift — a slow, subtle shift from solving real customer problems to optimising for internal metrics, efficiency, or short-term gains.

Let’s take a look at what I see as the biggest and often overlooked ways businesses lose their grip on real value.

1. Betting the Farm on Certainty (a.k.a. The Assumption Trap)

It’s not what you don’t know that kills you — it’s what you’re certain about that turns out not to be so.

- You’re so sure you already understand what customers want that you stop listening.

- You fall in love with your own solution, ignoring signals that it isn’t working.

- Since you never defined value in the first place, you cannot measure whether you’re delivering it.

Real-world example: Blockbuster thought customers valued movie selection. Netflix realised they valued convenience. Blockbuster doubled down on late fees and in-store experience, while Netflix removed friction entirely. One of those companies no longer exists.

2. The “Efficiency Above All” Fallacy

Chasing efficiency is great — until it erodes what makes your product or service valuable.

- You optimise for cost savings without considering whether you’re making the right things efficient.

- Cutting too much removes necessary slack, making the business fragile.

- Customers feel the cuts in subtle ways: slower service, degraded experience, and lost trust.

Real-world example: Think about the last time you booked a flight. You got lured in by the cheap base fare — only to be hit with baggage fees, seat selection charges, and hidden costs (bathroom charges, anyone?) By the time you checked in, you realized the ‘cheap’ flight wasn’t cheap at all. That’s the efficiency trap: the business wins today, but the customer never comes back.

3. The “More Features = More Value” Fallacy

Shipping more doesn’t mean delivering more value.

- Teams equate output with impact.

- Leaders reward teams for shipping features, not for solving actual problems.

- Customers end up with bloated, cluttered products that technically do more but feel worse.

Real-world example: Microsoft Word in the early 2000s vs. Google Docs. Microsoft packed Word with hundreds of features people barely used. Google kept it simple and focused on collaboration — what people actually needed.

4. The “We Must Monetise Everything” Trap

Nothing destroys customer goodwill faster than forcing them to pay for things they once got for free — without adding any new value.

- You take something customers love and start charging for it without considering the value tradeoff.

- You erode trust by turning experience into transactions.

- Customers leave, and suddenly, your revenue and user base start shrinking.

Real-world example: Twitter (X) locking basic features behind paywalls. Instead of creating new premium offerings, they started charging for things that had always been free. The result? Users left in droves.

5. The “Vanity Metrics” Illusion

You get what you measure — and sometimes, you measure the wrong stuff.

- You track what’s easy to measure, not what matters.

- Internal KPIs drive decisions instead of customer reality.

- Growth numbers look amazing — until you realise no one sticks around.

The double whammy: It costs far more to acquire new customers than to keep existing ones. If people aren’t staying, the product isn’t delivering real value, and you’re just throwing money at the problem to keep the illusion of success alive.

Real-world example: Many VC-backed startups chase rapid user acquisition, reporting skyrocketing new signups to investors. But if retention is awful, all they’ve done is build a leaky bucket — one that gets more expensive to keep filling over time.

6. The “Committees Kill Value” Problem

The more layers of approval required, the less risky (and often less valuable) the final output.

- Committees dilute strong ideas into safe, mediocre ones.

- No one wants to be the person who bets on something bold — so nothing bold happens.

- The result? A slow, risk-averse business that moves at half-speed.

Real-world example: Nokia knew smartphones were the future. However, corporate inertia and committee decision-making prevented them from acting in time. Apple moved decisively, and the rest is history.

7. The “False Demand” Delusion

You mistake internal pain for customer pain — and you end up solving the wrong problem.

- You think because something is frustrating inside the business, it must be frustrating for customers.

- You build a process-heavy solution for an internal problem — customers don’t care, and now your operations are even more complex.

Real-world example: Enterprise software vendors who over-engineer workflows based on their own internal processes rather than actual customer needs, leading to bloated, unusable tools.

8. The “Market Will Catch Up to Us” Fantasy

You assume that people will eventually see the value in what you’re building.

- You blame the market for not understanding your vision.

- You wait for behaviour to change rather than adapt to what customers want now.

- You spend years educating the market instead of building something it values.

Real-world example: Google Glass. The tech was impressive, but the market wasn’t ready for wearable smart glasses. Instead of adapting, Google assumed people would catch up. They didn’t.

9. The “You Are Not Your Customer” Fallacy

One of the most dangerous mistakes a business can make is assuming that what they find valuable is the same as what customers find valuable.

- Your internal team understands the product in a way your customers never will.

- What seems intuitive to you might be utterly confusing to them

- You build for yourself instead of for the actual people using the product.

The result? Overly complex products, messaging that doesn’t resonate and features nobody needs — because they were designed from an insider’s perspective rather than the customer’s reality.

Real-world example: Early smartphone makers (Nokia, BlackBerry) thought customers wanted hardware keyboards and enterprise security. Apple realised they valued touchscreen simplicity and the app ecosystem — and the iPhone changed everything.

Bringing It All Together: The Danger of Assumptions

Each of these traps boils down to one core mistake: mistaking assumptions for reality.

- Assuming you know what customers value — without testing, measuring, or listening.

- Assuming efficiency equals value — without questioning what you’re optimising.

- Assuming growth = success — without looking at retention or long-term sustainability.

- Assuming your customers think like you do — when, in reality, they don’t.

When businesses lose touch with how customers define value, they make costly, avoidable errors—whether they bet everything on the wrong idea, chase efficiency at the cost of experience, or build for themselves rather than their users.

The best companies don’t just optimise for cost — they optimise for value, constantly testing it, challenging assumptions they are making about it, and redefining it based on observations and learning.

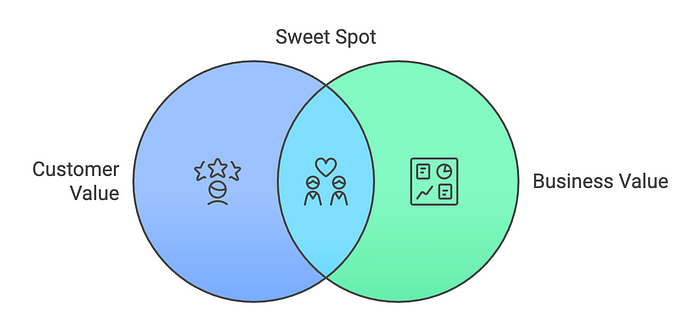

The Sweet Spot: Aligning Customer and Business Value

If the first half of this post was a tour through all the ways businesses lose sight of value, this is where we start to change the narrative and talk about how to right that wrong.

Let me start by reiterating that customer and business values aren’t in opposition. When done right, delivering what customers truly value should drive business success. The problem is that most companies optimise for one at the expense of the other — either chasing efficiency and monetisation at the cost of experience or over-indexing on delighting customers without a sustainable business model.

The real sweet spot is discovering what’s good for the customer is also good for the business.

1. User-Centered Design: Start With the Customer, Not the Business

A fundamental shift happens when companies stop asking, “What do we want to build?” and start asking, “What does the customer actually need?”

- User-centered design forces companies to think from the outside in. It’s not about what’s easy for the company but what makes sense for the user.

- It prevents the “You Are Not Your Customer” trap — designing based on observed user behaviour, not internal assumptions.

- Companies that invest in understanding their customers (through research, feedback loops, and continuous discovery) consistently outperform those that don’t.

Real-world example: Apple’s obsession with intuitive design. While competitors packed in features, Apple focused on making technology people wanted to use. The result? Higher customer loyalty, fewer support costs, and products that sell themselves.

2. Delivering Value, Not Just Features

Building more isn’t the same as building better, with the best companies focusing on solving problems, not adding features. They are asking:

- Does this solve a real user problem they care about?

- Does this improve the overall experience?

- Would customers miss this if it were removed?

Real-world example: Basecamp vs. Traditional Project Management Software. For years, project management tools kept getting more complex — Gantt charts, burndown reports, velocity tracking, deep integrations with dozens of enterprise systems. More features, they assumed, meant more value. Basecamp took a different approach. Instead of overwhelming users with endless functionality, it focused on simplicity — clear to-do lists, team communication, and a lightweight approach to project tracking. No bloat, no unnecessary complexity, just what teams actually needed to get work done. The result? Basecamp built a fiercely loyal user base, proving that more features don’t always mean more value — sometimes, they just mean more noise.

“Perfection is achieved not when there is nothing more to add, but when there is nothing left to take away.” — Antoine de Saint-Exupéry

3. Aligning Business Models With Customer Value

A great product with a poor business model won’t last. A great business model without customer value isn’t viable. The best companies align both.

- Usage-based pricing aligns value with customer needs (e.g., AWS, Stripe).

- Freemium models allow customers to experience value before paying (e.g., Notion, Figma).

- Subscription models prioritising retention over acquisition build sustainable businesses (e.g., Netflix focusing on content that keeps people subscribed).

Real-world example: John Lewis’ customer-first business model. Unlike many retailers focused on squeezing margins, John Lewis historically built loyalty through its commitment to fair pricing (‘Never Knowingly Undersold’) and employee ownership model. Because its staff (partners) share in the company’s success, the incentive isn’t just to maximise short-term profits and provide exceptional service and retain loyal customers.

4. Retention as the Ultimate Proof of Value

If customers stay, you’re delivering real value. If they don’t, you’re not.

- Acquiring a new customer is expensive — keeping one is much cheaper.

- A high churn rate means customers thought they saw value but didn’t experience enough to stay.

- Acquisition is flashy. Retention is what keeps you alive. Get onboarding right, and customers stay. Get it wrong, and they churn before you ever see a return.

Real-world example: Spotify vs. other streaming services. Spotify invests in personalisation (Discover Weekly, Wrapped, custom playlists), which keeps users engaged. Others rely on short-term promotions to get signups — but their retention suffers.

5. Feedback Loops: Measuring Value the Right Way

Companies obsessed with cost track every penny. Companies obsessed with value track what matters:

- Retention: Are customers sticking around?

- Advocacy: Would they recommend this product?

- Usage: Are they using key features regularly?

- Customer feedback: What are they saying?

Real-world example: Amazon’s relentless focus on customer feedback. They don’t just measure revenue; they track what customers say — and use that to drive improvements.

Bringing It All Together: The Value Flywheel

The best companies create a flywheel of value:

- Deeply understand what customers value.

- Build experiences that solve real problems.

- Align business incentives with delivering customer value.

- Measure and refine based on real-world feedback.

- Repeat.

When done right, customer value creates business value. The trick is resisting the short-term temptations that break the cycle.

How to Measure and Manage Value

Most businesses track costs down to the penny. They know precisely how much they spend on salaries, infrastructure, and marketing. But when it comes to value? That’s often left as a vague assumption.

The best companies don’t just assume they deliver value — they define it, measure it, and actively manage it. Here’s how.

1. Measure Retention, Not Just Growth

Acquisition gets all the attention, but retention is the real test of value. If customers stay, you’re delivering value. If they are leaving in droves, you’re not.

Key retention signals:

- Churn rate — How many customers leave over time?

- Time-to-value (TTV) — How quickly do new users experience value?

- Expansion revenue — Are customers spending more over time?

Real-world example: Gym memberships vs. Peloton. Traditional gyms optimise for sign-ups, knowing most people will drop off after January. Peloton, on the other hand, focused on habit formation and engagement, ensuring customers kept coming back.

2. Track What Customers Use

Many businesses mistake shipping features for delivering value. Just because something exists in your product doesn’t mean it’s valuable.

- Feature adoption rate — What percentage of customers use a feature?

- Stickiness — How often do customers come back?

- “Would they miss it?” test — If you removed this feature, would anyone care?

Real-world example: Revolut vs. legacy banks. While traditional banks overload their apps with complex, rarely used features, Revolut tracks usage and prioritises what customers engage with — like real-time spending insights and fee-free international payments.

3. Use Customer Advocacy as a Signal of Value

Customers who truly find value in a product don’t just stick around — they actively bring others in. Instead of relying on the flawed “Would you recommend this?” question, businesses should track actual behaviours that indicate advocacy:

- Referral Rate — Are customers inviting others, not just saying they would?

- Word-of-Mouth Growth — What percentage of new customers come from organic recommendations?

- Usage Expansion — Do customers deepen their engagement over time (e.g., upgrading plans, using more features)?

- Customer Retention Over Time — Are more customers staying with the product long-term, or is churn increasing?

Real-world example: Monzo’s viral growth. Instead of relying on an NPS score, Monzo tracked referral signups, organic growth, and increased product usage (e.g., salary deposits, bill payments). Their real-world advocacy data was far more valuable than a survey question.

4. Align Internal Metrics With Customer Reality

Many businesses track vanity metrics that don’t reflect actual customer value. The key is to align internal success measures with customer success measures.

Bad metrics:

- Number of features shipped — Does not equal customer value.

- Total revenue — Doesn’t tell you if customers are happy.

- Page views/downloads — These don’t matter if engagement is low.

Better metrics:

- Customer lifetime value (CLV) — Are customers staying and spending?

- Task success rate — Can users complete key actions without frustration?

- Customer Engagement Score (CES) — Are customers actively using key features over time?

Real-world example: Amazon’s “customer obsession.” Instead of just tracking revenue, Amazon relentlessly measures customer satisfaction, delivery speed, and ease of use, ensuring that they keep customers, not just acquire them.

5. Close the Loop: Listen, Learn, Adapt

Value isn’t static — it evolves. The best companies have tight feedback loops to improve continuously:

- Direct customer feedback — Surveys, support tickets, qualitative insights.

- Behavioral data — What users do vs. what they say they want.

- Experimentation — A/B testing to see what delivers real impact.

Real-world example: Spotify’s personalisation. Instead of assuming what users want, Spotify constantly refines Discover Weekly, personalised playlists, and recommendations based on actual listening behavior.

Bringing It All Together: Value as a Living Metric

Measuring value isn’t a one-time exercise — it’s an ongoing process. The best companies:

- Focus on retention, not just acquisition.

- Measure what customers use and care about.

- Track advocacy — happy customers bring in more customers.

- Ditch vanity metrics in favour of meaningful ones.

- Constantly listen, learn, and adapt.

In the end, delivering value isn’t about what you say — it’s about what your customers experience.

Bringing It Back: The Mindset Shift

My mother’s wisdom wasn’t just about money — it was about thinking beyond the surface. “Cost is what you pay, value is what you get.” She knew that focusing only on price was a short-sighted way to make decisions. The same applies to business.

Too many companies obsess over cost, efficiency, and output, believing that’s how they win. But value isn’t what you build, what you charge, or even what you measure — it’s what your customers experience. And when businesses lose sight of that, they make costly mistakes:

- They bet the farm on a certainty that turns out to be wrong.

- They optimise for efficiency at the expense of experience.

- They mistake more features for more value.

- They chase new customers instead of keeping existing ones.

The best companies? They align customer and business value by:

- Understanding what customers care about.

- Designing products and services around real needs, not assumptions.

- Onboarding properly and focusing on retention, not just acquisition.

- Measuring actual behavior instead of vanity metrics.

- Building feedback loops that continuously refine value delivery.

In the end, value isn’t a number on a spreadsheet — it’s the difference between a product customers tolerate and one they can’t live without.

The companies that truly get this? They don’t just survive. They thrive.

Because in the long run, cost is what you pay, value is what you get.

“The bitterness of poor quality remains long after the sweetness of low price is forgotten.” — Benjamin Franklin

About Me

I’m Paul, a Partner at Thrivve Partners and a Product & Flow Practitioner, focused on data-informed, evidence-led ways of working. As a ProKanban trainer, I help teams and organisations navigate complexity, optimise flow, and deliver value — without getting trapped in rigid frameworks. I believe in leading with curiosity, not judgment — helping teams uncover better ways of working through exploration, learning, and continuous improvement.